Procedures for borrowing and repayment of foreign loans by residents being enterprise in Vietnam

Enterprises shall be permitted to directly borrow and repay foreign loans on the principle of self-borrowing, self-responsibility for repayment, use of loan capital for the correct objective, and comply with procedures for borrowing and repayment of foreign loans by residents being enterprise in Vietnam.

Post date: 14-12-2013

11,065 view(s)

Residents being enterprises which borrow and repay a foreign loan must satisfy the conditions for borrowing and repaying foreign loans, shall register the medium and long term loan, shall open and use a medium and long term loan capital account, must repay the foreign loan, shall withdraw capital and shall transfer money to repay the loan, and shall report the status of use of the loan in accordance with regulations of the State Bank of Vietnam.

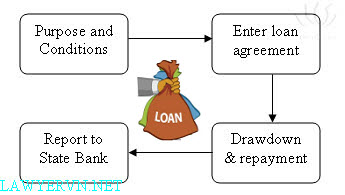

I. Procedures for short term borrowing and repayment of foreing loans by residents being enterprise in Vietnam:

Procedures for short term borrowing and repayment of foreign loans by residents being enterprise in Vietnam

1. Purpose of short term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Short term foreign loans shall be used to satisfy the requirement for working capital for production and business in accordance with the scope of operation of enterprises as stipulated in the business registration certificate, investment licence or operating licence issued by the competent authority

2. Conditions of short term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Applicable to enterprises with foreign owned capital, a short term foreign loan agreement shall only be entered into upon satisfaction of the following conditions:

- During the period of construction, it must be ensured that the balance of short term and medium term loans (including the balance of domestic loans) will not exceed loan limits and will not result in an increase of the total invested capital pursuant to the investment licence;

- When the enterprise has completed construction and commissioning of the project, it may borrow a short term loan to supplement working capital but shall not include such loan in the amount of the maximum stipulated total invested capital pursuant to the investment licence.

3. Enter loan agreement of short term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Enterprise shall enter the short term foreign borrowing with the purpose and meeting the conditions mentioned above.

4. Registration of short term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Enterprises shall not be required to register short term loans with the State Bank, but they must ensure short term foreign loan agreements satisfy the conditions stipulated in Section 2 above.

In the case of extension of a short term loan whereby the total duration of the original short term loan plus the extension is more than one year, the enterprise must conduct registration with the State Bank within thirty (30) working days from the date of signing the contract for extension and must comply with the provisions on medium and long term loans of State Bank of Vietnam.

5. Drawdown and repayment of foreign loans of by residents being enterprise in Vietnam

The transactions of drawdown and repayment of foreign loans of enterprises may only be carried out through one authorized bank, except for a number of transactions (where the authorized bank does not provide guarantees or services) as follows:

a. Drawdowns for direct payment to foreign beneficiaries in respect of imported goods and services;

b. Drawdowns and debt repayment through accounts of enterprises opened overseas (where enterprises are permitted to open overseas accounts);

c. Drawdowns in the form of import of goods and services with deferred payment and debt repayment in the form of export of goods and services.

Where enterprises are carrying out drawdowns and debt repayment through one authorized bank but wish to work with another authorized bank, they must finalize the transactions of drawdown and debt repayment at the former bank. In the case of medium and long term loans, enterprises must register with the State Bank the change of the bank providing the services of drawdown and debt repayment

Upon carrying out drawdowns and repayment of foreign loans through an authorized bank, enterprises shall implement the following:

(a) Drawdowns of short term foreign loans by residents being enterprise in Vietnam:

- Enterprises shall present to the authorized bank where the enterprise makes the drawdown, the original of the signed short term foreign loan agreement;

- Enterprises shall be responsible for presenting other essential documents and data at the request of authorized banks.

Where an enterprise does not make drawdowns through an authorized bank but only makes loan repayments through the authorized bank, within five days of a drawdown, the enterprise shall notify the authorized bank where it makes loan repayments in writing of the date of the drawdown and the amount withdrawn under the foreign loan agreement.

(b) Repayment of foreign loans by residents being enterprise in Vietnam:

Enterprises shall present to the authorized bank where enterprises make loan repayments the following documents:

- Original signed short foreign loan agreement;

- Original or copy (confirmed by the head of the enterprise) of source documents evidencing drawdowns under the short foreign loan agreement and other necessary documents and data at the request of the authorized bank.

Where an enterprise has made drawdowns through an authorized bank but does not make loan repayments through such authorized bank, within five days from the date of repayment, the enterprise shall notify the authorized bank where it made drawdowns in writing of the date of the repayment and the amount repaid under the foreign loan agreement.

6. Report of short term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Enterprises not being credit institutions shall forward reports to the branch of the State Bank in the province or city under central authority where such enterprise has its head office on the status of foreign loans on quarterly basis (at the latest by the 7th day of the first month of the following quarter) on the status of borrowing short term loans by such enterprise and on cases where drawdown and repayment of loans are not conducted through authorized banks in accordance with Report Form 1 (Download)

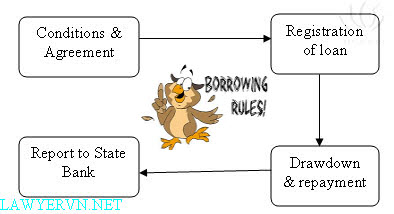

II. Procedure for medium and long term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Procedure for medium and long term borrowing and repayment of foreign loans by residents being enterprise in Vietnam

1. Conditions for medium and long term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Enterprises may only enter into medium or long term foreign loan agreements upon satisfaction of the following conditions:

a. Enterprises must have an investment project or production and business plan approved by the authorized body in accordance with law;

b. The foreign loan must be used to satisfy the requirements for production and business correctly in accordance with the scope of operation of the enterprise as stipulated in its business registration certificate, investment licence or operating licence issued by the competent authority;

c. The medium or long term foreign loan agreement of the enterprise must be consistent with the regulations of the Governor of the State Bank from time to time;

d. The contents of medium and long term foreign loan agreements of enterprises must be consistent with the current applicable provisions of the laws of Vietnam, such as opening of foreign currency accounts overseas for loan transactions; mortgages or pledges over the assets of enterprises; borrowing of foreign loans to contribute capital to the establishment of enterprises; assignment or conversion of debts into shareholding; and other matters stipulated by the laws of Vietnam;

e. With respect to an enterprise with foreign owned capital, in addition to satisfaction of the conditions stipulated in clauses mentioned above, it must be ensured that the balance of medium and long term loans (including the balance of domestic loans) of such enterprise will not exceed loan limits and will not result in an increase of the total invested capital pursuant to the investment licence;

2. Enter the loan agreement of medium and long term borrowing and repayment of foreign loans by residents being enterprise:

Based on the provisions in Section I above, enterprises shall be permitted to enter medium or long term foreign loan agreements

3. Registration of medium and long term borrowing and repayment of foreign loans by residents being enterprise in Vietnam:

Within thirty (30) working days from the date of signing an agreement and prior to a drawdown, the enterprises must register the borrowing and repayment of the foreign loan with the State Bank of Vietnam

A file for registration of borrowing and repayment of a foreign loan in respect of enterprises shall comprise:

a. Application for registration of borrowing and repayment of a foreign loan (in accordance with Form 1) (Download);

b. Notarized copy of decision on establishment and certificate of business registration; or investment licence; or operating licence and other relevant documents issued by the competent authority;

c. Notarized copy of the written approval from the relevant authority of the investment project or production and business plan (except for enterprises with foreign owned capital);

d. Copy and Vietnamese translation of the signed foreign loan agreement (confirmed by the head of the enterprise)

If there is any change at all relating to the details of a loan of an enterprise which are stipulated in the letter from the State Bank certifying registration of the borrowing and repayment of such foreign loan, the enterprise shall sign an agreement on the change after ensuring that the contents of the change comply with the provisions of Section I above. The enterprise must conduct registration of the change with the State Bank within thirty (30) working days from the date of signing the contract on the change and prior to the date of effectiveness of the changed details

A file for registration of changes shall comprise:

a. Application for registration of changes (in accordance with Form 2) (Download);

b. Copy of the signed agreement on changes and Vietnamese translation thereof (confirmed by the head of the enterprise);

c. Written approval of the changes from the guarantor of the foreign loan of the enterprise (in cases where the enterprise is guaranteed).

4. Certification of registration of borrowing and repayment of foreign loans and registration of changes

i. Authority to certify registration:

a) State Bank branches in provinces and cities under central authority shall certify registration and any changes of such registration for medium and long term loans of non-State owned enterprises located within their respective localities which have an amount of up to ten (10) million United States dollars (or another foreign currency with equivalent value at the time of signing of the foreign loan agreement).

b) The State Bank shall certify registration and changes of such registration in respect of medium and long term foreign loans of enterprises which are not covered in clause (a) mentioned above.

ii. Certification of registration by State Bank

The State Bank or a State Bank branch in a province or city under central authority shall certify registration of borrowing and repayment of foreign loans of enterprises and registration of changes and shall notify enterprises in writing within fifteen (15) working days from the date of receipt of complete and valid files of enterprises in relation to:

a. Certification of registration of borrowing and repayment of a foreign loan of an enterprise or certification of registration of a change in the foreign loan of the enterprise;

b. Refusal to certify registration of borrowing and repayment of a foreign loan of an enterprise or registration of a change in the foreign loan of the enterprise, in which case the State Bank shall provide its reasons for the refusal.

If additional information or other conditions are required in order to have a sufficient basis for certification or refusal to certify registration of borrowing and repayment of a foreign loan of an enterprise or of a change in the foreign loan of the enterprise, the State Bank or a State Bank branch in a province or city under central authority shall notify the enterprise within fifteen (15) working days from the date of receipt of the file from the enterprise.

5. Drawdown and repayment of foreign loans by residents being enterprise in Vietnam

The transactions of drawdown and repayment of foreign loans of enterprises may only be carried out through one authorized bank, except for a number of transactions (where the authorized bank does not provide guarantees or services) as follows:

a. Drawdowns for direct payment to foreign beneficiaries in respect of imported goods and services;

b. Drawdowns and debt repayment through accounts of enterprises opened overseas (where enterprises are permitted to open overseas accounts);

c. Drawdowns in the form of import of goods and services with deferred payment and debt repayment in the form of export of goods and services.

Where enterprises are carrying out drawdowns and debt repayment through one authorized bank but wish to work with another authorized bank, they must finalize the transactions of drawdown and debt repayment at the former bank. In the case of medium and long term loans, enterprises must register with the State Bank the change of the bank providing the services of drawdown and debt repayment

Upon carrying out drawdowns and repayment of foreign loans through an authorized bank, enterprises shall implement the following:

(a) Drawdowns of foreign loans by residents being enterprise in Vietnam:

- Enterprises shall present the original of the written certification from the State Bank of registration of borrowing and repayment of the foreign loan.

- Enterprises shall be responsible for presenting other essential documents and data at the request of authorized banks.

Where an enterprise does not make drawdowns through an authorized bank but only makes loan repayments through the authorized bank, within five days of a drawdown, the enterprise shall notify the authorized bank where it makes loan repayments in writing of the date of the drawdown and the amount withdrawn under the foreign loan agreement.

(b) Repayment of of foreign loans by residents being enterprise in Vietnam:

Enterprises shall present to the authorized bank where enterprises make loan repayments the following documents:

- Original of the written certification from the State Bank of registration of borrowing and repayment of the foreign loan;

- Original signed medium or long term foreign loan agreement;

- Original or copy (confirmed by the head of the enterprise) of source documents evidencing drawdowns under the medium or long term foreign loan agreement and other necessary documents and data at the request of the authorized bank.

Where an enterprise has made drawdowns through an authorized bank but does not make loan repayments through such authorized bank, within five days from the date of repayment, the enterprise shall notify the authorized bank where it made drawdowns in writing of the date of the repayment and the amount repaid under the foreign loan agreement.

6. Report of medium and long term borrowing and repayment of foreign loans by residents being enterprise in Vietnam

Enterprises shall forward reports to the branch of the State Bank in the province or city under central authority where such enterprise has its head office on the status of foreign loans on quarterly basis (at the latest by the 7th day of the first month of the following quarter) on the status of borrowing and repayment of medium and long term foreign loans in accordance with Report Form 2 (Download).

Lawyervn.net

Related texts:

- Register the long and medium term foreing loan with Stat Bank of Vietnam

Relate News

- › License to provide intermediary payment services in Vietnam

- › The intermediary payment services in Vietnam

- › Dossiers for registration of foreign loans in Vietnam

- › The procedure for the asset auction of bad loans and secured assets bought by VAMC

- › Registration of the operation of branches of foreign credit institutions in Vietnam

- › The procedures for mortgages of residential houses which will be formed in future

- › Credit institutions deploy the electronic banking services without approval of State Bank of Vietnam (SBV).

- › Overseas loans and guarantees extended by enterprises in Vietnam for non residents.

- › Permitted banks may export, import cash in foreign currency each time after when it is approved by the State Bank of Vietnam

Send your comment