The increase in the minimum wage, salary 2013 leads to the increase in other benefits

The increase in the minimum wage, salary 2013 leads to the increase in other benefits such as the benefits under the Law on Social Insurance, social insurance premiums for high salary laborer, health insurance rate, compensation for mental damages, Establishment of ownership rights to objects found.

Post date: 25-01-2014

6,601 view(s)

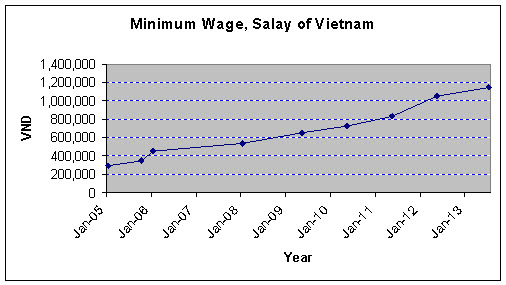

Minimum wage, salary of Vietnam by years

Vietnamese Government has issued Decree No.66/2013/CP-CP to increase minimum wage, salary from 1,050,000 VND to 1,100,000 VND, effective from 1 July 2013. The increase in the minimum wage 2013 leads to the increase in other benefits such as the benefits under the Law on Social Insurance, social insurance premiums for high salary laborer, health insurance rate, compensation for mental damages, Establishment of ownership rights to objects found.

1. The increase in minimum wage, salary 2013 leads to the increase in social insurance premium ceiling.

Under the provisions of paragraph 3 of Article 94 of the Law on Social Insurance 71/2006/QH11, social insurance ceiling is 20 months minimum wage. From the effective date of the Social Insurance Law (1/1/2007) So far, there has been 5 times the minimum wage, salary increased, resulted in social insurance premium ceiling increased, respectively, as follows:

|

Seq |

Time |

Decree |

Minimum wage/month |

Social insurance premium ceiling |

|

1 |

02/01/2005 |

203/2004/ND-CP |

290.000 đ |

5.800.000 đ |

|

2 |

01/10/2005 |

118/205/ND-CP |

350.000 đ |

7.000.000 đ |

|

3 |

01/01/2006 |

94/2006/ND-CP |

450.000 đ |

9.000.000 đ |

|

4 |

01/01/2008 |

166/2007/NĐ-CP |

540.000 đ |

10.800.000 đ |

|

5 |

01/05/2009 |

33/2009/NĐ-CP |

650.000 đ |

13.000.000 đ |

|

6 |

10/05/2010 |

28/2010/NĐ-CP |

730.000 đ |

14.600.000 đ |

|

7 |

01/05/2011 |

22/2011/NĐ-CP |

830.000 đ |

16.600.000 đ |

|

8 |

01/05/2012 |

31/2012/NĐ-CP |

1.050.000 đ |

21.000.000 đ |

|

9 |

01/07/2013 |

66/2013/ND-CP |

1.150.000 đ |

23.000.000 đ |

2. The increase in minimum wage, salary 2013 leads to the increase in social insurance benefits.

Most benefits from the Social Insurance Law 71/2006/QH11 the basic salary bases on the minimum wage, salary. If the new basic wage, salary is 1,150,000 VND / month as per Decree 66/2013/ND-CP, the benefits will be determined as follows:

|

No |

Article of SI Law |

Benefit type |

Enjoying rate |

Awarded amount |

|

1 |

Article 34 |

Lump-sum allowance upon childbirth or child adoption per each child |

2 month salary |

2.300.000 đ |

|

2 |

Point 2 Article 37 |

Leave for convalescence and health rehabilitation after childbirth at home (maximum 15days) |

25%/day (or 40%) |

287.500 đ or 460.000 đ |

|

3 |

Point 2 Article26 |

Convalescence and health rehabilitation after sickness at home (maximum 15 days) |

25%/day (or 40%) |

287.500 đ or 460.000 đ |

|

4 |

Point 2 Article42 |

The lump-sum allowance from a 5% working capacity decrease |

5 month salary |

5.750.000 đ |

|

5 |

Point 2 Article43 |

Monthly allowance from a 31% working capacity decrease |

30%/month |

345.000 đ |

|

6 |

Article 46 |

Attendance allowance from a working capacity decrease of at least 81% due to rachioplegia, total blindness, paraplegia, amputation of two legs or a mental disease |

100%/month |

1.150.000 đ |

|

7 |

Article 47 |

Lump-sum allowance for death due to labor accident or occupational disease |

36 month salary |

41.400.000 đ |

|

8 |

Point 1 Article48 |

The daily benefit from convalescence and health rehabilitation after treatment of injury or sickness (maximum 10days) |

25%/day |

287.500 đ |

|

9 |

Point 2 Article63 |

Funeral allowance |

10 month salary |

11.500.000 đ |

|

10 |

Point 1 Article65 |

Monthly survivorship allowance + Having paid social insurance 15 years + Being pensioners + Being accident allowance of a working capacity decrease of at least 61% |

50%/month |

575.000 đ |

3. The increase in minimum wage, salary 2013 leads to the increase of health insurance awarded.

Health Insurance Law No. 25/2008/QH12 do not regulate the health insurance rate in some specific cases. Instead, the Government guided the detailed provisions by the Decree 62/2009/ND-CP also based on the minimum wage:

|

No |

Decree 62/2009/NĐ-CP |

Type expense |

Ratio for enjoying |

Awarded amount |

|

1 |

Point c, Clause 1, Article 7 (See Document No. 1800/BHXH-CSYT on 15/5/2012) |

The totally free medical care costs |

15%/time |

172.500 đ |

|

2 |

Point c, Clause 1, Article 7 (See Document No. 1800/BHXH-CSYT on 15/5/2012) |

Maximum cost for medical services of high technology or treatment with high expense |

40 month salary |

46.000.000 đ |

4. The increase in minimum wage, salary 2013 leads to the increase in compensation for mental damages.

Some mental loss may be determined by Court Judge also base on the minimum wage to in respect with the maximum amount of compensation in the event the parties can not reach an agreement. If the new minimum wage, salariy is 1,150,000 VND/month of Decree 66/2013/ND-CP and regulations on compensation for non-contractual civil transactions in Resolution No. 03/2006/NQ-HDTP, the compensation on for the mental loss from the time of 1/7/2013 will increase as follows:

|

No |

Resolution 03/2006/NQ-HĐTP |

Compensation type |

Maximum limit |

Compensation amount |

|

1 |

Point c, Clause 1.5 of Section II |

Compensation for the loss of mental health infringed |

30 month salary |

34.500.000 đ |

|

2 |

Point d, Clause 2.4 of Section II |

Mental damage compensation due to compromised life (i.e. causes the death of another person) |

60 month salary |

69.000.000 đ |

|

3 |

Point c, Clause 3.3 of Section II |

Compensation for mental damages violated the honor and dignity |

10 month salary |

11.500.000 đ |

5. The increase in minimum wage, salary 2013 leads to the increase amount of establishment of ownership rights to buried or sunken objects which are found (Article 240, Civil Codes)

Ownership rights to a discovered, buried or sunken object without an owner or with its owner being unidentifiable, after deducting expenses for search and preservation, shall be determined as follows:

a. The found object, which is a historical or cultural relic, shall belong to the State; the person who found such object shall be entitled to a monetary reward as provided for by law.

b. The found object, which is not a historical or cultural relic but has the value of up to ten months’ minimum salary set by the State, shall come under ownership of the discoverer; if the found object is valued higher than ten months’ minimum salary set by the State, the discoverer shall be entitled to a value equal to ten months’ minimum salary set by the State and 50% of the value of the portion in excess of ten months’ minimum salary set by the State, and the remainder shall belong to the State.

6. The increase in minimum wage, salary 2013 leads to the increase in amount of establishment of ownership rights to objects which have been let drop on the ground or left over out of inadvertence by other persons (Article 241 Civil Codes 2005)

a. A person who finds an object which another person has let drop on the ground or left over out of inadvertence and knows the latter’s address must notify or return the object to such person; if he/she does not know the address of the latter, he/she must notify or submit such object to the People’s Committee of the commune, ward or township or the nearest police Station in order to make a public announcement for the owner to be aware thereof and reclaim it.

The local People’s Committee or the police station, which has received the object, must notify the person who has submitted it of the results of identification of the owner.

b. If after one year from the date of public announcement of the found object, it is not possible to identify the owner or the owner does not come to reclaim the object, such object shall belong to the finder, if the object has the value of up to ten months’ minimum salary set by the State; if the object’s value is greater than ten months’ minimum salary set by the State, after deducting the expenses for preservation, the finder shall be entitled to a value equal to ten months’ minimum salary set by the State and 50% of the value of the portion in excess of ten months’ minimum salary set by the State, and the remaining value shall belong to the State.

c. If the object which has been let drop on the ground or left over out of inadvertence is a historical or cultural relic and its owner is unidentifiable or no one comes to reclaim the object, the object shall belong to the State; the finder of the object shall be entitled to a monetary reward as provided for by law.

7. The increase in minimum wage, salary 2013 leads to the increase in the shift meal amount.

Although there are no regulations regarding the required amount will be increased by shift meal limits upon minimum wage, however, such amount has increased from time to time corresponding to the minimum wage increased as follows:

|

No |

Time |

Circular of Labor Ministry |

Shift meals/ month |

|

1 |

Prior 01/05/2009 |

22/2008/TT-BLĐTBXH |

450.000 đ |

|

2 |

From 01/05/2009 – 30/04/2011 |

10/2009/TT-BLĐTBXH |

550.000 đ |

|

3 |

From 01/05/2011 – 30/04/2012 |

12/2011/TT-BLĐTBXH |

620.000 đ |

|

4 |

From 01/05/2012 |

10/2012/TT-BLĐTBXH |

680.000 đ |

According to Documents No.1942/TCT-CS dated 8/6/2011 of General Department of Tax, the shift meals norm is applied to calculate the reasonable cost and free from taxable income of the employee. The excess above has not been accounted for in reasonable cost, and also included in taxable income.

Lawyervn.net

Send your comment