About forms of foreign investment in Vietnam

About the forms of foreign direct and indirect investment in Vietnam

Post date: 05-09-2013

11,462 view(s)

1 Forms of investment in vietnam

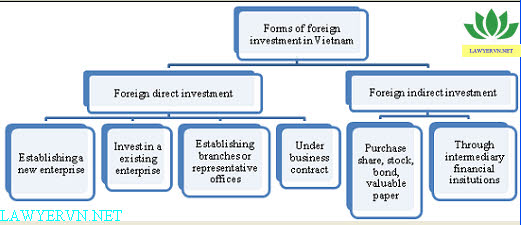

There are two principal forms of foreign investment in Viet Nam:

• Direct investment – where the investor invests capital and participates in the management of the investment under following forms: establishing a new enterprise in Vietnam (see point 2.1 below), investing in an existing enterprise (see point 2.2 below), establising a branch or representative office (see point 2.3 below), investing under business contract (see point 2.4 below).

• Indirect investment – where the investor invests through the purchase of shares, securities or through intermediary financial institutions where the investor does not participate directly in the management of the investment activity (see point 3 below).

About forms of foreign investment in Vietnam

2 Forms of direct foreign investment in Vietnam

A foreign investor can directly engage in the Vietnamese market in several ways. Foreign investors must determine whether they wish to invest alone or with other foreigners, or partner with one or more Vietnamese investors. At the same time, investors must consider and choose the most appropriate form of investment, including whether to establish a new company, invest in an existing company with an active management role, or pursue an alternative form of investment presence, such as a branch, representative office or Business Cooperation Contract.

The choice of investment form in Vietnam will depend primarily on the investment aim. It may also be dictated by particular rules applying to particular sectors. For example, for investments in the services sector, the commitments made by Viet Nam when it joined the WTO will be a key determinant in selecting the form of investment. Authorities generally apply these commitments as de-facto limitations on foreign ownership, approving foreign investment only up to the level agreed in the schedule of commitments. Some of these commitments specify that investment in certain service sectors may only be made in the form of a joint venture with a Vietnamese partner.

2.1 Form of investment in Vietnam by establishing a new enterprise

Legal forms permitted under the Law on Enterprises include limited liability companies (single or multi members), joint stock companies, partnerships and private enterprises. Most foreign invested enterprises are established as limited liability companies or joint stock companies.

Foreign invested enterprises with a single investor may only be established as a limited liability company. A joint stock company must have at least three shareholders. Different considerations should be taken into account in selecting the entity to be established, as the governance regime, financing options, disclosure requirements and other operational aspects of the entities differ depending on whether the investment is carried out by a limited liability company or a joint stock company.

a. Form of investment in Vietnam by establishing a multi-Member Limited Liability Company (“MMLLC”)

An MMLLC is a company in which an investor (referred to as “member”) is liable for the debts and other commercial obligations of the company up to the amount of capital that the member has undertaken to contribute to the company. Members of an MMLLC may be organisations or individuals.

An MMLLC must have at least two members and not more than 50. The company attains legal entity status from the date of issuance of its business registration certificate (which is issued in the form of an investment certificate to foreign investors). 100% foreign-owned enterprises with more than one foreign investor, as well as foreign invested joint venture enterprises, may be established as an MMLLC.

An MMLLC is managed by a members’ council which includes all of the members (who may be individuals or representatives of corporate members), a chairman of the members’ council and a general director. A limited liability company with eleven members or more must have an inspection committee. The members of an MMLLC may choose either the chairman of the members’ council or the general director as the legal representative of the company, who is vested with the power to represent and bind the company.

b. Form of investment in Vietnam by establishing a single-member Limited Liability Company (“SMLLC”)

An SMLLC is a limited liability company with a single investor, such as a 100% foreign-owned enterprise with only one parent company or one individual. The single investor in an SMLLC is defined as the owner of the SMLLC. The owner may appoint a single authorised representative to represent its equity interest and act as the chairman of the SMLLC. Alternatively, the owner may appoint more than one authorised representative to represent its equity interest and all of the authorised representatives constitute the members’ council of the SMLLC. The owner also appoints one individual among the authorised representative to act as the chairman.

The legal representative of an SMLLC may be either the chairman of the company or the general director as decided by the owner. Each SMLLC is required to appoint from one to three supervisors. The supervisor has a role that is similar to that of an audit committee, although the supervisor‘s reports are submitted directly to the members.

The legal representative of the company must permanently reside in Vietnam. If he or she is absent from Vietnam for more than 30 days, another person must be authorised to act on his or her behalf in accordance with the provisions of the company’s charter.

c. Form of investment in Vietnam by establishing a joint stock company (“JSC”)

A JSC (or shareholding company) is a company whose charter capital is divided into shares and shareholders are liable for the debts and other property obligations of the company up to the amount of capital they have contributed or are liable to contribute to the company.

Shareholders may be corporate entities or individuals. The minimum number of shareholders is three and there is no restriction on the maximum number of shareholders. A JSC may issue securities to the public to raise capital in accordance with Vietnam’s securities laws.

A JSC obtains legal entity status from the date of issuance of its business registration certificate. Foreign investors may establish a JSC, provided that the number of foreign and/or domestic investors in the company is at least three.

The highest decision-making body of a JSC is the general meeting of shareholders. A JSC is managed by a board of management and a general director. JSCs with more than 11 individual shareholders, or one shareholder who owns more than 50% of the total number of shares, are required to have an inspection committee.

The chairman of the board of management or the general director – as determined by the company’s charter – is the legal representative of the company. The legal representative must permanently reside in Vietnam. If he or she is absent from Vietnam for more than 30 days, another person must be authorised to act on his or her behalf.

A JSC must issue ordinary shares and may also issue preferred shares which may include:

• voting preferred shares (that are non-transferable)

• dividend preferred shares

• redeemable preferred shares and

• other preferred shares as specified in the company’s Charter

d. Form of investment in Vietnam by establishinga partnership company

A partnership is an enterprise with no fewer than two individual partners (if only two partners, both must be general partners) who are joint owners of the enterprise and who carry out business under a common name. General partners of a partnership have unlimited liability for the obligations of the partnership.

A partnership under Vietnamese law is a separate legal entity (despite the general partners’ unlimited liability) and obtains its status from the date its business registration certificate is issued.

In addition to having at least two general partners, a partnership may have one or more limited partners. Limited partners are liable for the debts of the partnership only to the extent of the amount of capital they have committed to contribute to the partnership.

The overall management of the partnership is carried out by the partners’ council which includes all partners, including limited partners. However, limited partners are not permitted to participate in the day-to-day management of the partnership or carry out business activities in the name of the partnership.

2.2 Form of investment in Vietnam by investing in an existing enterprise

Investors may also choose to directly invest in Viet Nam by acquiring a stake in an existing Vietnamese enterprise. Often, extensive internal and external authority approvals will be required. The precise procedural requirements for effecting such an acquisition will differ depending on:

• whether the target entity already has foreign investors and an Investment Certificate for an approved project;

• whether the investor is acquiring existing equity by way of transfer, or newly issued equity;

• the form of the target entity (whether a single or multiple-member limited liability company, or a shareholding company); and

• the sector in which the entity operates.

2.3 Form of investment in Vietnam by establising branches and representative offices

As an alternative to establishing, or investing in, a Vietnamese established enterprise, Viet Nam”s Commercial Law allows certain foreign business entities to establish two other forms of presence in Viet Nam: a branch or representative office. Both must be licensed by the relevant authorities. Foreign businesses intending to operate a representative or branch office in certain sectors such as banking, finance, legal services, culture, education, trading, tobacco and tourism should note that the stablishment and operation of these entities is regulated by specific legislation and not the Law on Commerce and its general provisions on representative offices and branches.

2.3.1 Form of investment in Vietnam by establishing a representative office (“RO”)

Representative offices are one of the most popular vehicles for foreign companies to establish a business presence in Vietnam. The main function of an RO is to seek business opportunities, market research, marketing, liaising with authorities regarding investment in Viet Nam for the parent company and to monitor the performance of contracts that the parent company has entered into in Vietnam.

ROs are not permitted to generate profits from operations in Vietnam, execute contracts in their own name, make or receive payments directly, purchase local goods directly for export, or distribute imported products on behalf of their head offices. ROs may, however, lease office space in Vietnam, employ Vietnamese and foreign staff and enter into contracts in connection with their permitted operations.

Generally, ROs of foreign trading or service companies are allowed to operate for a five year term which may be extended.

2.3.2 Form of investment in Vietnam by establishing a branch office

Branch offices of foreign companies have the right to conduct business activities for their own account, execute contracts in their own name, and carry out all other commercial activities for which they are licensed. Of note, the right to conduct commercial activities in respect of restricted goods and services will only be available as scheduled in Vietnam’s international undertakings.

The Ministry of Industry and Trade is authorised to grant, amend or withdraw licenses for branch offices that engage in trading activities and most other services. State Bank of Vietnam is authorized to grant license for foreign bank branches operation in Vietnam.

2.4 Form of investment in Vietnam under business contract

a. Build-Operate-Transfer contracts in Vietnam

For infrastructure projects, the Build-Operate-Transfer (“BOT”) structure is the primary investment form for foreign investors in Vietnam. The BOT form of investment is discussed in more detail below.

b. Business Cooperation Contract (BCC)

A BCC is a written agreement between a foreign investor and a Vietnamese partner which does not establish a separate legal entity. The parties to a business cooperation contract are licensed to operate and implement a specific project in Vietnam to share the revenue or profits arising from such activities.

The main disadvantage of a business cooperation contract is that the parties have unlimited liability for the debts of the

commercial activities of the parties. To reduce such exposure, a foreign party could consider setting up an offshore investment vehicle which then enters into a business cooperation contract with the local party(ies).

3 Forms of Indirect foreign investment in Vietnam

The forms of indirect foreign investment in Viet Nam includes: a) Purchase of shares, securities, bonds and other valuable papers; b) Through securities investment funds; c) Through other intermediary financial institutions.

The primary form of indirect foreign investment into Viet Nam is via the country”s stock exchanges. Indirect investment in this form requires comparatively less regulatory approval than direct investment, concentrating on administrative requirements such as the establishment and registration of trading codes and accounts, and periodic disclosures.

A non-resident foreign investor must open an indirect investment capital Vietnamese dong account at an authorized credit institution in order to carry out an indirect investment in Vietnam. Investment capital in a foreign currency must be sold for Vietnamese dong in order to carry out an indirect investment in Vietnam. All transactions relating to indirect investment activities must be conducted via the indirect investment capital Vietnamese dong account.

Regulation of the Vietnamese securities market, and foreign investment in the market, is considered in more detail in relevant pages.

Lawyervn.net

Send your comment