Foreign Account Tax Compliance Act (FATCA) of United States

Foreign financial institutions that do not implement the provisions of FATCA face a 30% withholding tax on certain U.S.-source payments made to them.

Post date: 18-11-2013

4,073 view(s)

Foreign Account Tax Compliance Act (FATCA)

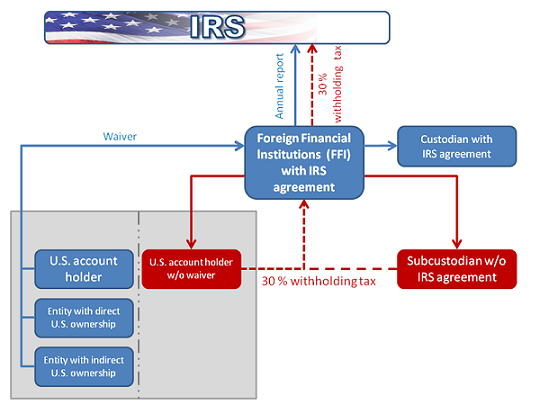

Foreign Account Tax Compliance Act (FATCA) was passed by United States in 2010. FATCA targets tax non-compliance by U.S. taxpayers with foreign accounts at Foreign Financial Institutions (FFIs). FATCA focuses on reporting By foreign financial institutions about financial accounts held by U.S. taxpayers or foreign entities in which U.S. taxpayers hold a substantial ownership interest. Unless otherwise exempt, FFIs that do not both register and agree to report face a 30% withholding tax on certain U.S.-source payments made to them .

comment(s) (0)

Services

Statistics

User Accessed 4,322,874

User Online8

customer information

Professional

Lastest News

© copyright by LAWYER VIETNAM LAW FIRM

- Powered by IM Group

Send your comment